New Market Pre-Entry Advisory

·Industries: industries entry and license requirements

·Legal entity: registration requirements, location study

·Accounting and audit: accounting standards, financial reporting, audit requirements

·Tax: tax types, tax rate, tax base and tax administration

·Regulatory advisory: tax incentives, labor laws, industrial policies, government subsidies, ESG and environmental protection policies, product quality regulations

·Trade and foreign exchange management: trade regulations, foreign exchange management

·Human resources: work permits, compensation and benefits, talent recruitment

·Intellectual property

·Local culture

Implementation Assistance

·Product export: products compliance, import & export customs and tax

·Overseas company registration: accounting and tax compliance

·Staff assignment: international assignment

·Overseas plant establishment: location selection, government relations, policies advisory

Operational Assistance

·Local bookkeeping, ttax filing, and consulting

·Transfer pricing mechanism design

·Cross-border financial and tax process design and consulting

·Application for local incentive policies

·Human resources services: payroll, social security, individual income tax

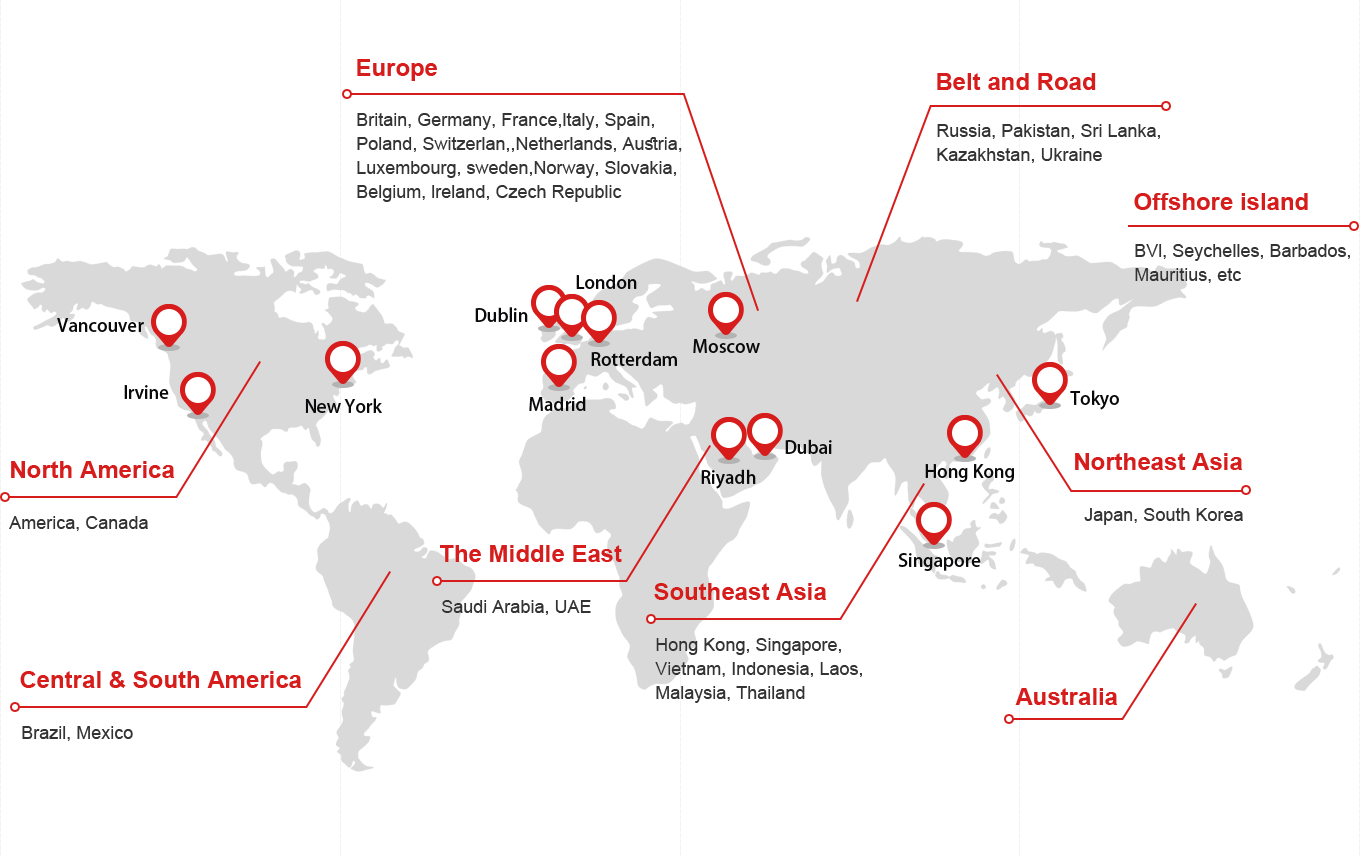

With years of experiences since its establishment in Shanghai China, Gosea is a professional tax firm active in the fields of tax, finance management, consulting and a variety of related areas. Due to our multicultural background, we have solid understanding of the problems and needs of Chinese companies expanding globally.

With offices in 20+ countries and regions worldwide, Gosea is able to provide clients’ cross-border business the localized professional support.

Gosea has gradually developed into one of the Chinese tax firms with the widest presence in developing countries along “the Belt and the Road”, and its overseas offices are still expending.

-

Receiving authorization letters

-

Saudi Arabia VAT registration

-

Australia GST registration

-

Financial representation

-

Compliance filing

-

Brazil tax registration

-

Canada GST & HST registration

-

Japan JST registration

-

Tax ID cancellation

-

Tax outsourcing services

-

Mexico RFC registration

-

U.S. Sales Tax & Use Tax registration

-

UAE VAT registration

-

Tax audit response and support

-

Ireland VAT registration

-

Singapore GST

-

EU VAT refund

-

Shopify tax setup

-

Amazon tax setup

-

UK VAT registration

-

Germany VAT registration

-

France VAT registration

-

Spain VAT registration

-

Finland VAT registration

-

Netherlands VAT registration

-

Belgium VAT registration

-

Norway VAT registration

-

Switzerland VAT registration

-

IOSS

-

OSS

Overseas Company

Registration & Tax Declaration

-

Company RegistrationThere are always a variety of legal entity types in each country/regions,e.g. limited liability company, partnership, joint venture, etc. to meet different investment demands.

· Advice on proper investment vehicle

· Business registration

· Virtual / physical office address options

· Bank account opening

· Work visa application

· Tax registration

· License application

· Company secretarial services

· Free trade zone services

· Hague certification

· Cross-border settlement support

-

BranchIn some countries/regions, foreign investors are allowed in open branch under a foreign company which will save administrative cost and may somehow avoid outbound investment process for some foreign investors.

· Advice on limitation on activities of branch

· Business registration

· Tax compliance

· Bookkeeping

· Local representative service

-

Representative OfficeIf the activities in an overseas country are preliminary, it is good to have an initial office to test the market with a minimal cost.

· Work permit and via for foreign representative

· Social security, payroll and tax for locals

· Tax compliance

· Invoicing and bank payment limitations

-

Non-resident EstablishmentFor project-based activities, an establishment registered for the non-resident foreign company are very common in some countries/regions, e.g. European Union. The compliance burden is not high for such establishment, but can be different from other types of presence.

· Assessment of tax implications

· Tax registration

· Employer registration

· Special tax requirements for project, if any

· Employment arrangement

· Work permit and visa

· VAT filing

· Bookkeeping

· Annual report and tax filing